|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

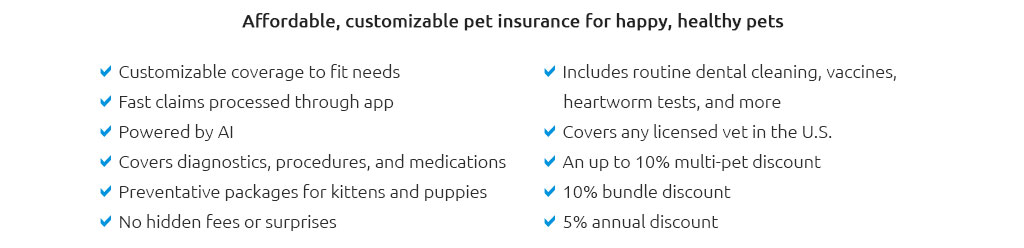

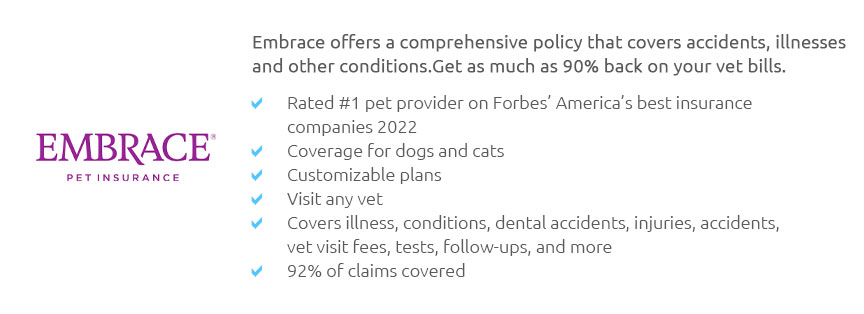

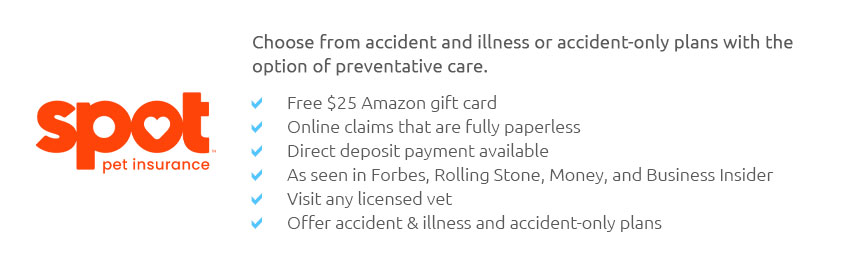

Understanding Pet Insurance in Oklahoma: What to ExpectWhen it comes to safeguarding the health and wellbeing of our cherished furry companions, pet insurance emerges as a significant consideration for many pet owners in Oklahoma. In a state where the love for pets runs deep, understanding the nuances of pet insurance can be crucial to making informed decisions that ensure both peace of mind and financial stability. Pet insurance in Oklahoma, much like in other states, offers a safety net against unexpected veterinary expenses, which can sometimes spiral into financial burdens. At its core, pet insurance functions similarly to human health insurance. It helps cover the costs associated with various medical treatments, ranging from routine check-ups to more significant medical interventions. However, the specifics of what is covered can vary significantly between providers and plans. Generally, pet insurance plans in Oklahoma can be categorized into three primary types: accident-only, time-limited, and lifetime coverage. Accident-only plans typically cover injuries resulting from unforeseen incidents, which might appeal to pet owners with particularly adventurous animals. Time-limited plans offer coverage for specific conditions but within a set timeframe, which can be a middle-ground option for those concerned about particular health issues. Lastly, lifetime coverage is often the most comprehensive, covering ongoing conditions throughout the pet’s life, but it tends to come with a higher premium. When navigating the landscape of pet insurance in Oklahoma, several factors should be considered. Firstly, the cost of premiums can vary based on the breed, age, and health status of the pet. For instance, insuring a young, healthy dog may be less expensive compared to an older pet with pre-existing conditions. Moreover, deductibles, co-payments, and reimbursement levels also play a pivotal role in determining the overall cost-effectiveness of a policy. It's essential for pet owners to carefully read the terms and conditions to avoid surprises when filing claims. Additionally, Oklahoma pet owners may find value in reviewing customer testimonials and reviews to gauge the reliability and responsiveness of different insurance providers. Local forums and community groups can offer firsthand insights into the experiences of fellow pet owners, which can be invaluable when selecting a provider. Furthermore, given the unpredictable nature of veterinary emergencies, it's wise to consider the waiting period associated with each policy. This period, which varies by provider, is the time before coverage kicks in after the policy's purchase. Understanding these intricacies can help pet owners make a choice that aligns with their needs and expectations.

In conclusion, pet insurance in Oklahoma is not just about mitigating financial risk but also about ensuring that our pets receive the best possible care without hesitation. By staying well-informed and considering the various options and factors at play, pet owners can make decisions that reflect both their financial situation and their commitment to their pet's health. As with any insurance product, due diligence and thoughtful consideration are key. In a state that treasures its pets, having the right insurance can make all the difference in maintaining their health and happiness. https://www.petinsurance.com/whats-covered/oklahoma/

Get comprehensive pet insurance coverage in Oklahoma. Protect your furry friend's health and save on vet bills with Nationwide. Explore our plans today! https://www.metlifepetinsurance.com/state/oklahoma/

Explore MetLife's flexible, affordable pet insurance coverage in Oklahoma! Get a quote today, and help your pets stay healthy while you save on vet bills. https://www.lemonade.com/pet/explained/oklahoma-pet-insurance-guide/

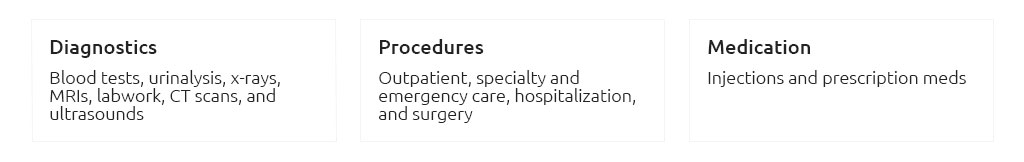

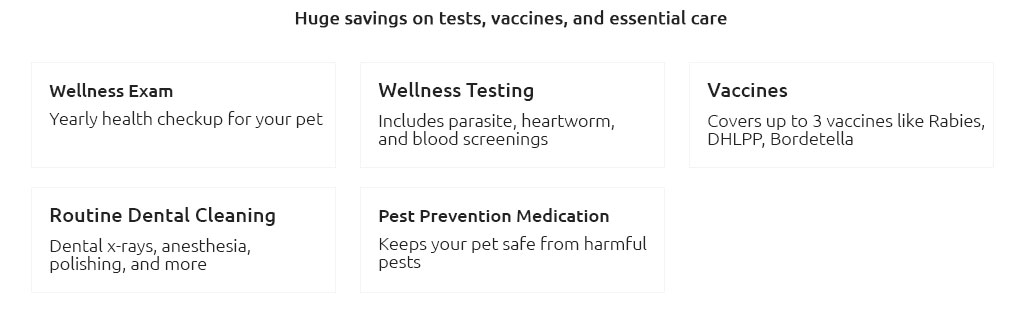

eligible accidents and illnesses. Here are some common types of care that Lemonade pet insurance ...

|